One NZ X Youtap Limited

They wish to expand their loyalty program beyond

with Trade-in rewards

AND new digital wallet.

What are their objectives?

Objective 1

Objective 2

Objective 3

Increase customers engagement to ONE NZ products / upsell and cross-sell.

Reason 1

Easy implementation of loyalty program to allow users into have access to promotions such as rewards, and cash back with wallet

Reason 2

To improve accessibility to their trade-in reward points accumulated, along with any other loyalty points gained by the user through promotions. By doing so, it becomes present a grater personalised transaction experience.

1

In order to better understand the product I decided to research different use cases of loyalty program. This way I can understand the specification and idea towards future development for ONE NZ

Airpoints

Loyalty Program

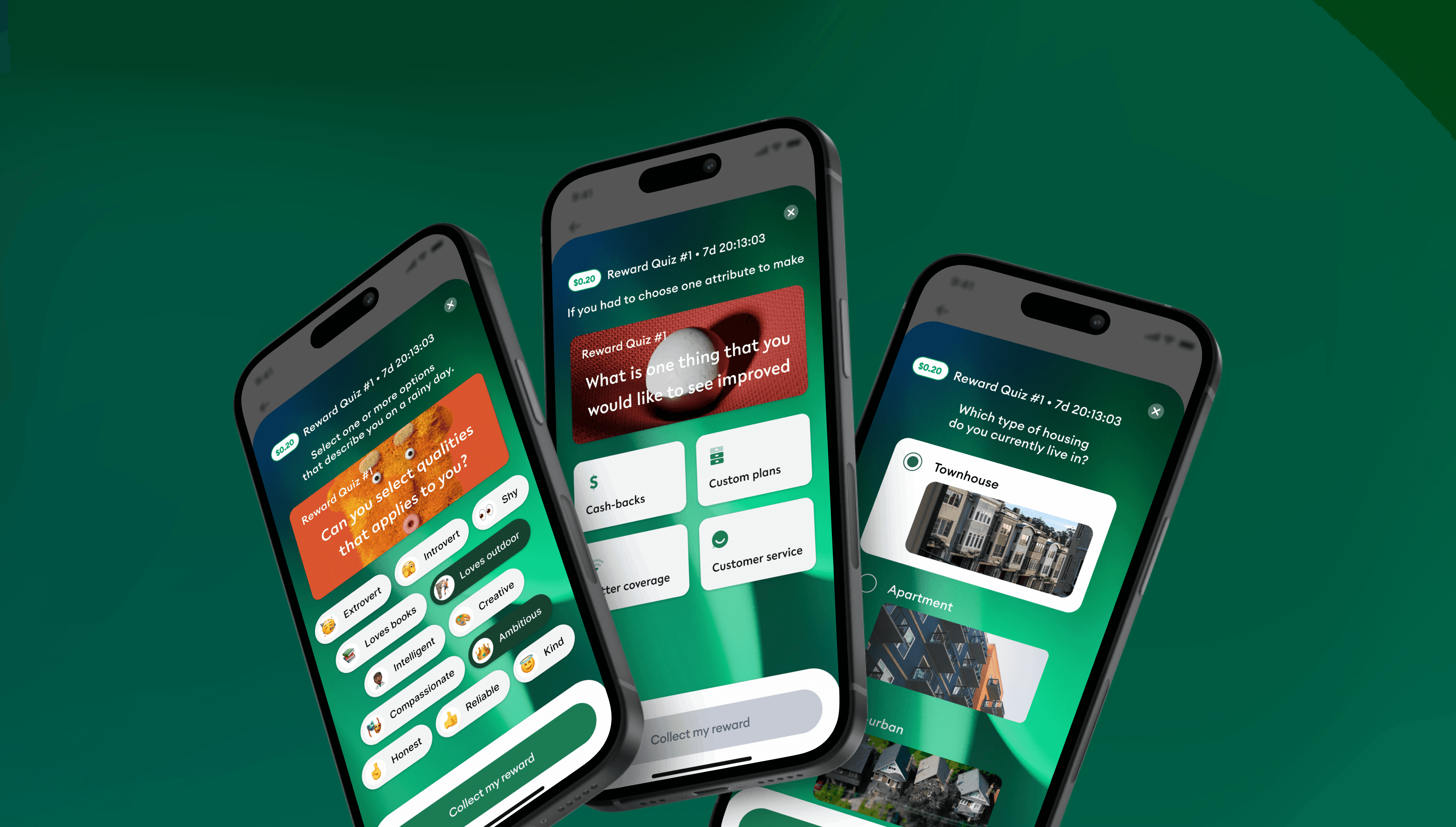

How airlines have become central banks

In 2021 United Airline has released financial statement about how their subsidary of ‘Mileage Plus Holding, LLC’ as collateral to borrow Billions of dollars

In 2018 American airline made

$1.9 Billlions in profit despite that fact they had loss of 0.43cent per mile for every seats for such reason.

How has it started?

By Loyalty Program and Partnership.

Enhancing program (Frequent flyer membership) members’ experience by providing perks and services that differentiate from normal passengers. E.g. Lounge access, free upgrade, and boarding priorities.

Partnership with external companies -

The loyalty points are sold to fixed value to external companies. Back in 1982, American airline initiated collaboration with Hertz to reward customers with airpoints when renting a car.

This caused synergy of more frequent spending on airfares, as customers wanted to take advantage of airpoints

Another use case is when American Airline joined with Citi bank to initiate the credit card as mean to provide loyalty points to bank customers.

What else?

Airlines became central bank.

No TAX. As the nature of loyalty program is treated as rebate and cashback; which is to be claimed back by customer, it cannot be taxed.

This opened up for more partnership with external companies

Airlines are essentially behaving as central bank of their own currency.

On top of that there banks are operating as private for profit, there is not limitation how much currency become available.

What happened after?

Airpoints gained purchase power

Point = Money

Airpoints are now able to used to purchase goods and services

Airline continuous expansion of their value based as loyalty members grow

Starbucks

Loyalty Program

Customers are their bank

2.1 Billion in reward revenue

Introduction of their digital point wallet to top up and store. Starbucks invest these as interest free loans

User behaviour data to tailor offers, and new products tailored to entice more spending

How has it started?

Digital wallet application

In 2021, instead of payment with cash or credit card. Customers were allowed top up on their application and was rewarded with double the points to be used towards free drinks.

Due to great reputation and review of their application, people were eager to leave amount of money in their account.

The application only allows you to top up in pre-set amount, forcing customers to top up more than required

What else?

Gamification to keep clock work

Their star reward system and introduction of tier system was introduced as gamification to attract users

What happened after?

Customers’ exponential growth of digital balance allowed them to take on free loan

As users always had left over balance for future purchase, the top up values allowed Starbucks to use it to reinvest with 0% interest

The accumulated balance of all users excceed 2.1 Billion dollars in value.

2

Based on the research, I have summarised the keypoints regarding the loyalty program which I could focus on when designing the flows.

Easy accessibility to the wallet via mobile

Access to their digital wallet to track and redeem rewards with seamless integration with mobile experience has been the key factor identified as designed user experience.

Tool to understand the spending habits

Investigate if the loyalty program influences spending habits. For instance, do users spend more to earn rewards, as suggested by the airline example?

User retention - Gamification

Explore strategies to keep users coming back to the program. For instance, what mechanisms encourage users to continue participating in the program after initial engagement?

User motivations

Incentives: Understand what motivates users to engage with the loyalty program. For airlines, perks like upgrades and priority boarding are key, while for Starbucks, the ability to earn free drinks is crucial.

Perceived Value of the business and consumer

Understand and define how the Business and Consumers are to perceive the loyalty points.

Future developments, Clarify the stage of execution

Clarify the stage of execution. Loyalty program is progressive; by setting up infrastructure and collective strategy with external businesses.

It is mean to collect behavioural data

Loyalty program is not just on attraction but a mean to collect user data, which is refactored back into the product as development.

Loyalty = Currency. Increase of market value

The points and reward can be packaged to behave like currency which increase will affect the business’s value.

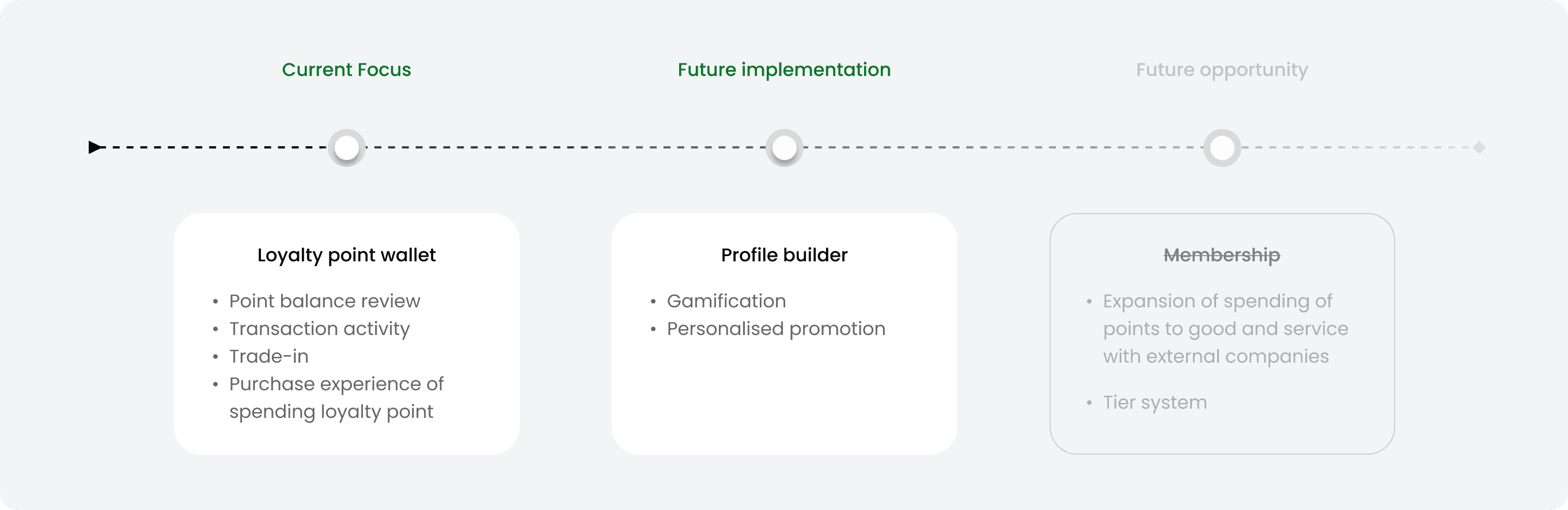

Exploration of solutions

Based on the research and anlysis, I reaslied the intention of the the trade-in experience is not the main point of digital wallet implementation. The focus is, use the trade-in as the trigger to expand the loyalty and reward beyond to be more competitive in the market. This can be noticed as One NZ is the only company that provide rewards to their users.

As designer for the implementation, our team has explored design solutions that aligns with One NZ’s intention foresee what the future implementation there be. This not only provide idea for One NZ, it also upsells our product as a company

Proposal breakdowns:

Introduce digital wallet dedicated for One NZ loyalty program with trade-in as the focus.

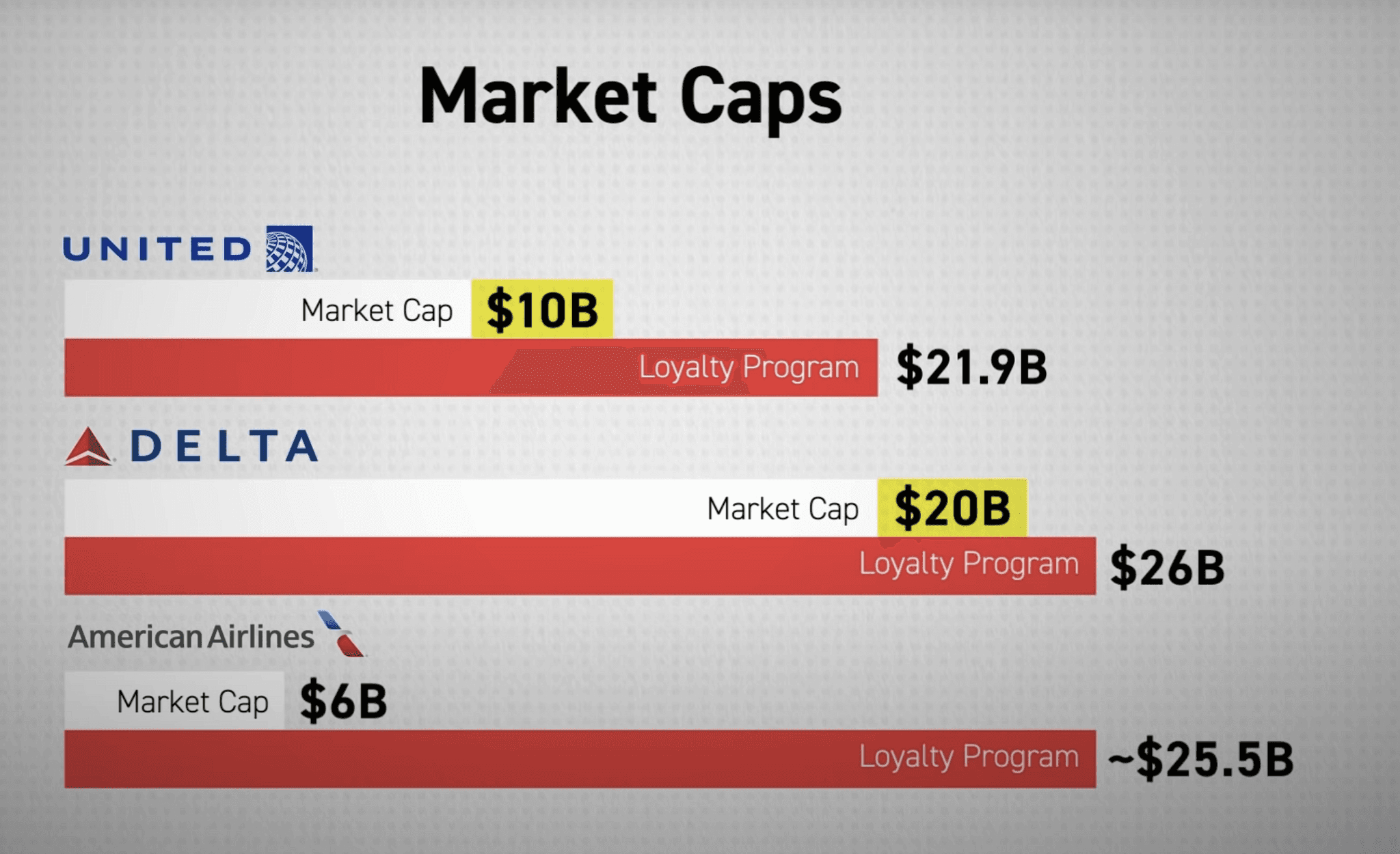

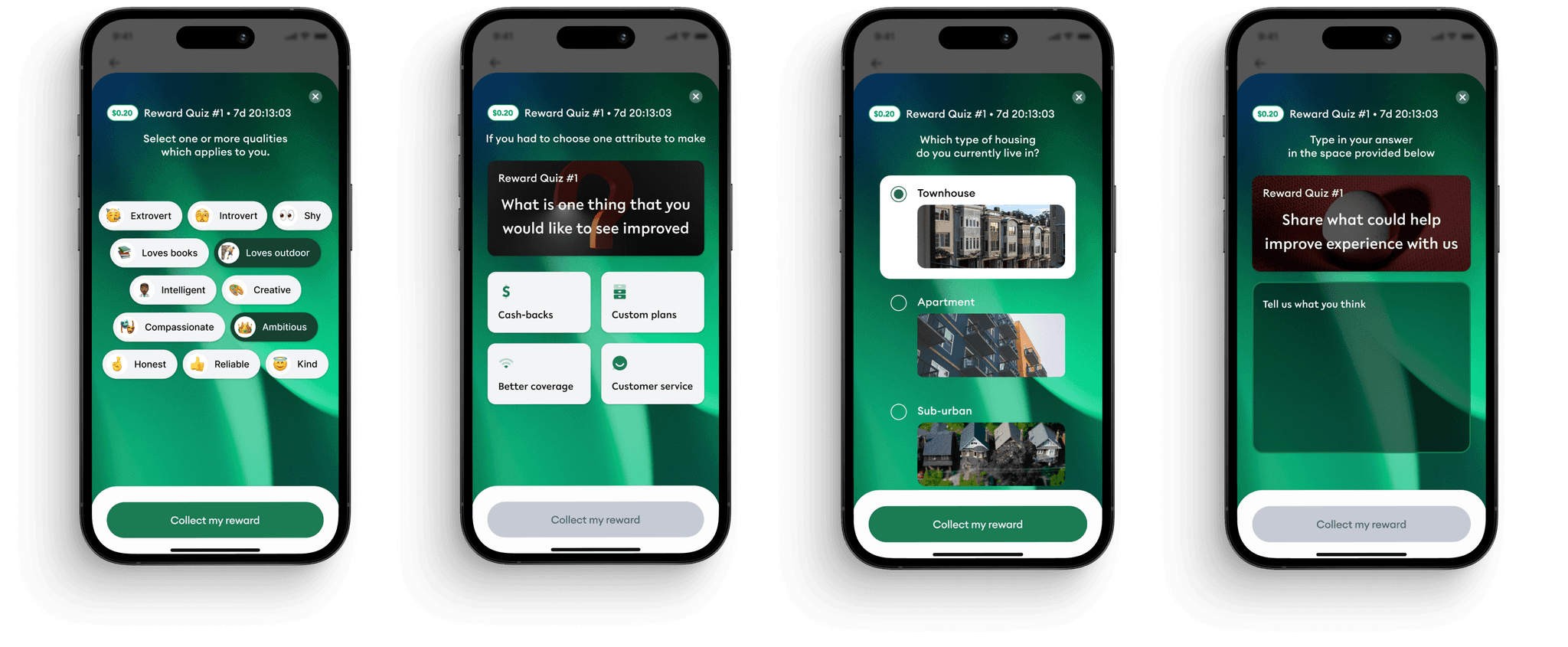

Introduce gamification to engage users to collect free rewards upon completion of smaller task. T

The first 2 stages, create a system that allows One NZ to introduce closed loop system payment system with other external brands to enhance on the catalogue of goods and service.

Here are the solutions we have provided as loyalty program

Trade-in, save, and manage

Have complete control over the balance you earned from trading in your devices.

Store it in your digital wallet

Personalised promotions to use your points

Have complete control over the spending of the wallet balance.

Provide platform for users with ONE NZ as transactional service

GAMIFICATION AND REWARDS

Complete tasks and gain points.

Each points you earn will go towards any purchase of your choice

LEARN ABOUT USER AND PERSONALISE THEIR REWARDS

Understand the user at greater level.

Through collections of tasks, we can identify the pain points and needs of the customer.

It helps provide desirable product tailored for each customer.

Track your balance history

We have defined rules and all states of transaction activity to customise our existing transaction history to be tailored to loyalty program and trade-in experience

Offer earned

Offer redeemed

Offer Expired

Trade-in

Void

(trade in reversal)

Trade-in Expired

Phone purchase